China and India Manufacturing: Risks and FDA Monitoring in Pharma Supply Chains

Dec, 17 2025

Dec, 17 2025

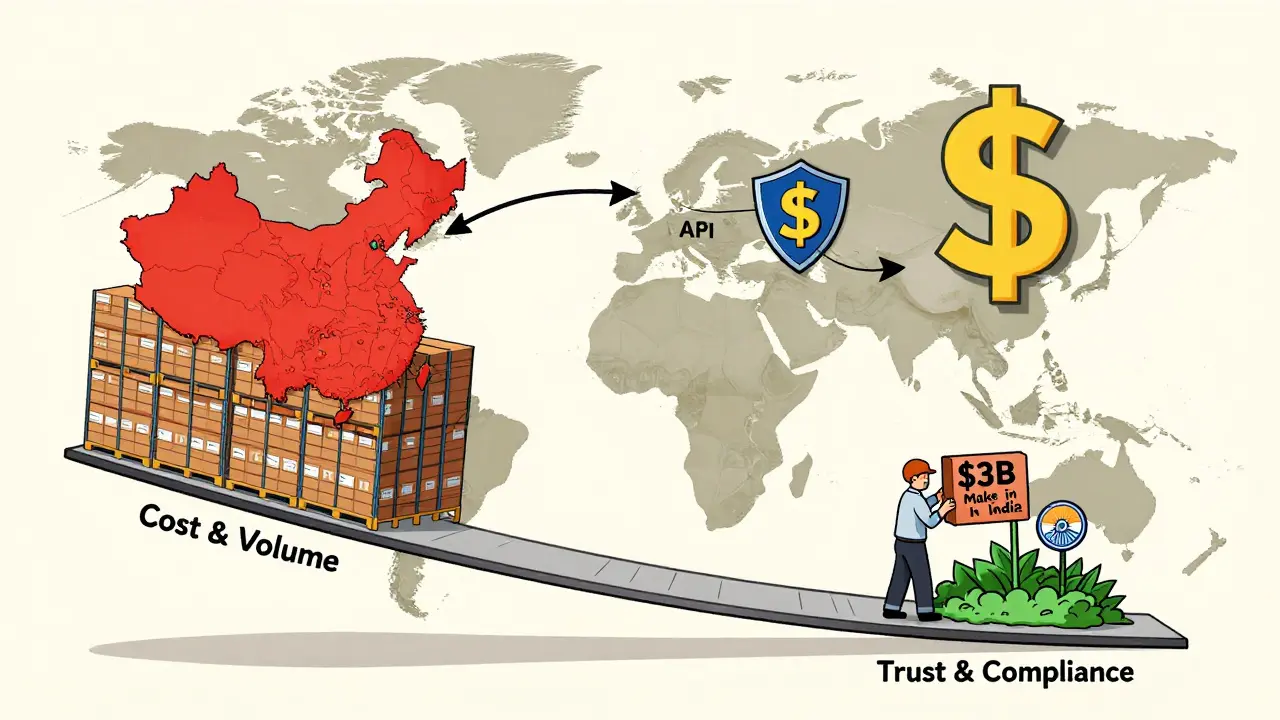

When you take a pill for high blood pressure or an antibiotic, there’s a good chance it was made in China or India. These two countries together supply more than half the world’s generic medicines and active pharmaceutical ingredients (APIs). But behind the low prices and steady supply lies a complex reality: China and India manufacturing aren’t equally safe, and the FDA watches them very differently.

Why the FDA Cares So Much

The U.S. Food and Drug Administration doesn’t just approve drugs - it inspects where they’re made. In 2023, nearly 40% of all FDA inspections of drug manufacturing sites happened overseas. Most of those were in China and India. Why? Because 80% of the world’s generic APIs come from these two countries. That means if a factory in Hyderabad or Shanghai cuts corners, millions of people could get a bad batch of medicine. The FDA doesn’t have offices in every country, so they send inspectors to check facilities. These inspections are tough. They look at everything: how clean the floors are, whether workers wear gloves, if equipment is properly calibrated, and if records are falsified. A single Form 483 - the FDA’s official notice of violations - can delay shipments for months. And if a facility gets flagged repeatedly, the FDA can block all imports from that site.India’s Compliance Edge

India has over 100 FDA-approved drug manufacturing plants. China has just 28. That’s not a typo. India has nearly four times as many facilities cleared by the FDA. Why? Because Indian companies learned early that compliance wasn’t optional - it was the price of entry into Western markets. Indian manufacturers started focusing on quality after the 1990s, when global buyers began demanding WHO-GMP and FDA standards. Today, many Indian plants use digital systems to track every step of production. Sensors monitor temperature in real time. Barcodes track batches from raw material to finished pill. Mistakes are caught before they leave the factory. FDA inspection data from 2020 to 2023 shows Indian facilities received 30% fewer Form 483 observations than Chinese ones. That means fewer warnings, fewer delays, and more trust from U.S. buyers. Global pharma companies call this India’s "solid compliance history." It’s why so many have adopted the "China+1" strategy - meaning they keep some production in China but move key operations to India as a backup.China’s Scale, China’s Risk

China makes more drugs overall. It controls 80% of the global API supply. It’s cheaper. It’s faster. But quality isn’t consistent. In 2023, 37% of Chinese pharmaceutical facilities faced FDA import alerts - nearly double the rate of Indian facilities. These alerts mean the FDA has reason to believe products from that site may be unsafe. They don’t automatically block shipments, but they add layers of scrutiny: more inspections, more paperwork, longer delays. The problem isn’t just bad actors. It’s scale. China has thousands of small and medium-sized manufacturers. Many lack the capital to upgrade equipment or hire trained quality staff. Some cut costs by using substandard raw materials or skipping validation tests. The FDA has caught cases where labs manipulated data or failed to clean equipment between batches. Geopolitical tension hasn’t helped. The U.S. government now sees China’s dominance in pharma as a national security risk. That’s led to more aggressive inspections and less tolerance for errors. What used to be a warning might now be a ban.The Hidden Weakness: India’s Dependence on China

Here’s the twist: India depends on China for its own medicines. In 2024, India imported 72% of its bulk drug ingredients from China - up from 66% just two years earlier. That means even if India makes perfect pills, the raw materials inside them might come from a factory under FDA scrutiny. This creates a dangerous blind spot. A U.S. company might think it’s sourcing from "safe" India, but the API in that drug could be from a Chinese plant with a history of violations. One senior procurement executive at a major American pharma firm told Bain & Company: "The 72% import dependency on China creates a single point of failure in our supply chain. We’re urgently trying to fix it." India knows this too. That’s why it’s pouring $3 billion into the "Make in India" program - offering cash incentives to companies that produce APIs domestically. The goal? Reduce that 72% to under 40% by 2030. But building API factories takes years. And China still has the edge in cost and volume.What Happens When the FDA Says No

When the FDA issues an import alert, it doesn’t just stop one shipment. It blocks all future shipments from that facility until the problems are fixed and re-inspected. That can take six months or more. For a company that relies on a single supplier, that’s a crisis. In 2022, a major U.S. insulin manufacturer lost access to its only API supplier in China after an FDA inspection found microbial contamination. The company scrambled to find alternatives. It took 14 months to switch. Patients faced shortages. The company lost $200 million in revenue. India’s system is more resilient because it has dozens of approved suppliers. If one plant gets flagged, companies can shift production to another. That’s not always possible in China, where supply chains are more centralized and less flexible.