Patent Litigation: How Authorized Generics Undermine Generic Drug Competition

Nov, 17 2025

Nov, 17 2025

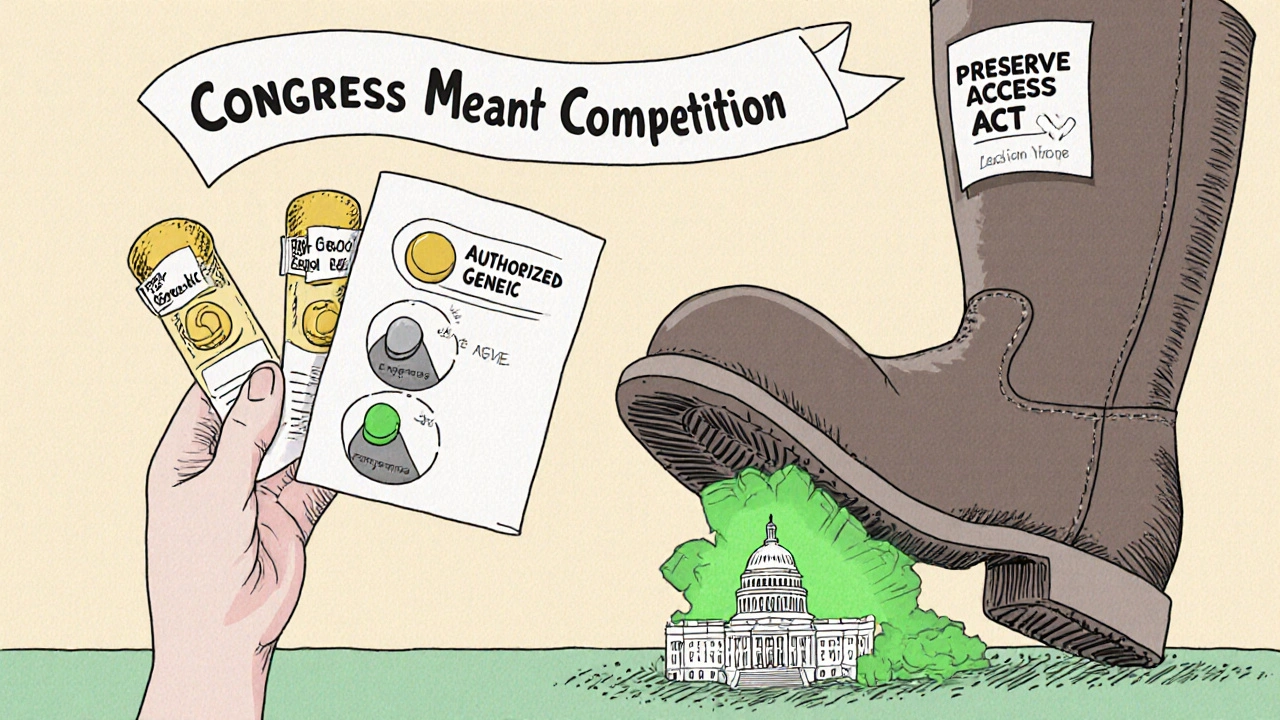

When a brand-name drug’s patent runs out, the market expects a flood of cheap generics. That’s the whole point of the Hatch-Waxman Act-to balance innovation with access. But in practice, something else often happens: the same company that made the brand-name drug launches its own version under a generic label. This is called an authorized generic. And it doesn’t just compete with generics-it often kills them before they even get started.

What Exactly Is an Authorized Generic?

An authorized generic isn’t a new drug. It’s the exact same pill, capsule, or injection as the brand-name version-same active ingredient, same factory, same packaging, just without the brand name on it. The company that owns the patent simply relabels its product and sells it under a generic name. No new FDA approval is needed. It’s legal, but it’s not what Congress had in mind when it created the 180-day exclusivity window for the first generic company to challenge a patent. Think of it like this: you’re the first person to open a coffee shop across the street from a giant chain. The chain lets you have the street to yourself for six months. But then, right before you open, the chain opens its own coffee shop right next door-with the same beans, same baristas, same price-and calls it "Generic Brew." Now your 180-day monopoly is gone before you even turn on the espresso machine.How Authorized Generics Sabotage the First Generic Entrant

The first generic company to successfully challenge a patent gets 180 days of exclusive rights to sell the generic version. That’s their reward for spending millions on lawsuits and regulatory filings. During that time, they’re supposed to capture 80-90% of the generic market. But when an authorized generic enters, that number drops to 30-40%. The Federal Trade Commission found that authorized generics take 25-35% of the market share during that critical window. Worse, they don’t drop prices like real generics do. They start at 15-20% below the brand-name price-still way higher than what independent generics charge. So now you’ve got three price tiers: brand (highest), authorized generic (middle), and real generic (lowest). The real generic gets squeezed out. Its revenue drops by 40-52% during the exclusivity period. And even after 180 days, those companies see 53-62% lower revenue over the next 30 months compared to markets without authorized generics. Teva Pharmaceutical reported a $275 million revenue loss in 2018 alone because of authorized generics on just a few of their products. That’s not a rounding error. That’s a company’s entire R&D budget for a year.The Secret Deals Behind the Scenes

Here’s where it gets darker. Between 2004 and 2010, about 25% of patent litigation settlements between brand-name and generic companies included a hidden deal: the brand promised not to launch an authorized generic-so long as the generic company delayed its market entry. These are called "reverse payment" settlements. The brand pays the generic company not to compete. Sometimes it’s cash. Sometimes it’s a promise not to launch an authorized generic. Either way, the result is the same: consumers wait longer for low-cost drugs. In one study, these deals delayed generic entry by an average of 37.9 months. That’s over three years of monopoly pricing. The FTC calls this the "most egregious form of anti-competitive behavior" in pharma. And they’re not just talking. Since 2020, they’ve opened 17 investigations into these kinds of arrangements. In 2022, their director made it clear: "We will challenge any arrangement that uses authorized generics to circumvent the competitive structure Congress established in Hatch-Waxman."

Why Do Brands Do It? The Pro-Competition Argument

You might wonder: if authorized generics lower prices, isn’t that good for patients? The pharmaceutical industry says yes. PhRMA argues that authorized generics increase competition by adding supply. A 2024 Health Affairs study claimed pharmacies paid 13-18% less for generics when an authorized version was available. But here’s the catch: that price drop doesn’t come from the real generic. It comes from the brand’s own product being priced lower than its branded version. The real generic still gets crushed. And if the brand had never launched an authorized generic, the real generic would have dropped prices even further-maybe 60-70% below the brand price. Instead, the market settles for a 30-40% discount, because the authorized generic sets the floor. It’s not competition. It’s controlled competition. The brand gets to decide who wins and who loses.Who Benefits? Who Gets Hurt?

Let’s break it down:- Brand-name companies keep profits high. They sell the same drug twice-once under the brand name, once under the generic label-and capture more market share than they would if real generics were allowed to dominate.

- Authorized generics benefit pharmacy benefit managers (PBMs). About 68% of PBM executives prefer formularies that include them because they offer a middle-tier pricing option. But that’s about cost management, not patient savings.

- Independent generic manufacturers get crushed. Their business model relies on being the first and cheapest. Authorized generics destroy that advantage.

- Patients and taxpayers pay more. Medicare could have saved $4.7 billion over ten years if authorized generics were banned during the exclusivity period, according to the Congressional Budget Office.

The Changing Landscape: Are Authorized Generics on the Way Out?

There’s good news: the practice is declining. In 2010, 42% of generic drug markets saw an authorized generic launch. By 2022, that number dropped to 28%. Why? Because regulators are watching. Courts are cracking down. And companies are learning that these deals are risky. In 2013, the Supreme Court ruled in FTC v. Actavis that reverse payment settlements could violate antitrust law. That sent a signal. Now, 92% of patent settlement agreements include explicit language about authorized generic entry-because lawyers know the FTC is watching. Legislation is also catching up. In March 2023, Senators Amy Klobuchar and Chuck Grassley reintroduced the Preserve Access to Affordable Generics and Biosimilars Act, which would ban agreements that delay authorized generic entry. If it passes, it could end the practice for good.What This Means for the Future of Generic Drugs

The Hatch-Waxman Act was meant to make generics a powerful tool to lower drug prices. But authorized generics turned it into a loophole. Instead of encouraging competition, they’ve created a system where the biggest players control who gets to compete-and at what price. For generic companies, the math is simple: if you’re going to spend $10 million on a patent lawsuit, but then face an authorized generic that steals half your market, is it worth it? For small generic firms, the answer is often no. That’s why the Congressional Research Service warns that for low-sales drugs (13% of all drugs), the threat of an authorized generic can kill a patent challenge before it even starts. If we want real competition in the generic drug market, we need to close this loophole. Authorized generics aren’t helping patients. They’re helping corporations protect profits under the guise of competition.What’s Next?

The next few years will be critical. Will Congress pass the Preserve Access Act? Will the FTC bring more cases? Will more generic companies refuse to settle if they know an authorized generic is coming? One thing is clear: the current system isn’t working. Patients deserve real generic competition-not a brand-name company pretending to be one.Are authorized generics the same as regular generics?

Yes and no. Authorized generics are physically identical to the brand-name drug-they come from the same factory, have the same ingredients, and are made under the same conditions. But they’re not the same as regular generics. Regular generics are made by independent companies that had to challenge the patent in court. Authorized generics are made by the brand-name company itself, just repackaged. That’s why they’re called "authorized"-they’re officially approved by the original maker.

Why do authorized generics cost more than regular generics?

Because they’re not meant to be the cheapest option. Authorized generics are priced just below the brand-name drug-usually 15-20% lower-to compete with the original product. Regular generics, made by independent companies, can drop prices much further-often 60-80% below the brand-because they don’t have to recoup R&D costs or maintain brand loyalty. Authorized generics are a pricing tool, not a discount tool.

Do authorized generics help lower drug prices overall?

They lower prices slightly compared to the brand-name drug, but they prevent real generics from driving prices down further. Studies show that without authorized generics, the first generic company would capture 80-90% of the market and set a much lower price floor. With them, the market settles for a middle-tier price, which means patients pay more over time. The FTC found that authorized generics reduce generic company revenues by over 50%, which discourages future patent challenges.

Is it legal for brand companies to launch their own generics?

Yes, it’s currently legal under the Hatch-Waxman Act. The FDA allows it because authorized generics don’t require new clinical data-they’re just a relabeling of the existing approved product. But legality doesn’t mean fairness. The FTC, Congress, and many independent generic manufacturers argue that this practice undermines the competitive intent of the law. Courts have started to scrutinize it more closely, especially when it’s tied to reverse payment settlements.

What’s being done to stop authorized generics from harming competition?

The FTC is actively investigating agreements that delay generic entry in exchange for not launching an authorized generic. In 2022, they made it clear they’ll challenge any deal that uses authorized generics to block competition. Congress is also considering the Preserve Access to Affordable Generics and Biosimilars Act, which would ban these practices outright. Meanwhile, more generic companies are refusing to settle unless they’re guaranteed no authorized generic will enter their exclusivity window.

satya pradeep

November 18, 2025 AT 00:23Authorized generics are just corporate sleight of hand. Same pill, same factory, same profit margin - just a new label. It’s not competition, it’s sabotage dressed up as a discount.

Kathryn Ware

November 20, 2025 AT 00:02This is exactly why I’ve been screaming into the void about PBMs for years. They don’t care about patients - they care about tiered pricing structures that look good on spreadsheets. Authorized generics are the perfect middle finger to real competition because they let PBMs say, ‘Look, we have a cheaper option!’ while still keeping prices artificially high. The real generics? They’re the ones getting crushed so the system can keep spinning. And don’t even get me started on how this disincentivizes small companies from even trying to challenge patents. 💔

shubham seth

November 21, 2025 AT 14:02Let’s be real - this isn’t capitalism. It’s corporate feudalism with FDA stamps. The brand-name guys are playing 4D chess while the little generic shops are stuck playing checkers with one hand tied behind their back. Teva losing $275M? That’s not a business hiccup - that’s a death sentence for innovation. And the worst part? The people who designed this system know exactly what they’re doing. They just don’t care if it kills access. 🤡

kora ortiz

November 23, 2025 AT 07:50If we want real drug affordability we need to cut the middlemen and punish these loopholes. The Hatch-Waxman Act was a promise - and this is how they broke it. No more pretending this is about competition. It’s about control. And it’s time we treated it like the fraud it is. 🚫

Jeremy Hernandez

November 23, 2025 AT 23:10Wow. So the system is rigged. Who saw that coming? 😴

Elia DOnald Maluleke

November 25, 2025 AT 07:59One must ask: is the market truly a free space when the very architects of the rules are permitted to rewrite them mid-game? The authorized generic is not merely a commercial maneuver - it is a metaphysical betrayal of the social contract implicit in patent law. Congress intended to balance innovation with equity; what we witness now is the commodification of justice. The FDA, once a guardian of public health, has become a bureaucratic veil for corporate consolidation. The patient, the taxpayer, the small manufacturer - all are rendered as mere variables in an equation of profit. And yet, we are told this is ‘competition.’ A language so twisted it has lost its moral compass. The law is not broken - it is perverted. And we, the people, are its silent accomplices.

Leslie Douglas-Churchwell

November 27, 2025 AT 00:23THIS IS THE NEW THERAPEUTIC DECEPTION. 😱 The pharma giants are literally manufacturing fake competition to trick regulators, PBMs, and YOU. Authorized generics are a psychological weapon - they make you think you’re getting a deal while the real winners are the ones who own both brands. And don’t even get me started on the reverse payment settlements - that’s not a business deal, that’s a cartel with a law degree. 🕵️♀️💸 The FTC is barely scratching the surface. I bet 90% of these deals are still hidden in NDAs buried in offshore shell companies. They’re not just gaming the system - they’re rewriting reality. Wake up. This is the new opioid crisis - just slower, legal, and dressed in lab coats.

Tarryne Rolle

November 27, 2025 AT 22:17But what if… the real problem isn’t authorized generics… but the entire concept of patent monopolies? Maybe we shouldn’t be fixing loopholes - maybe we should dismantle the whole structure. Why should any company own the rights to a molecule for 20 years? Why are we letting corporations dictate health outcomes through legal fiction? The authorized generic is just a symptom. The disease is intellectual property itself.

Prem Hungry

November 27, 2025 AT 22:49Hey - I know this is heavy, but hear me out. If you’re a small generic manufacturer reading this, you’re not alone. The system’s rigged, yes - but there are still winnable fights. Join coalitions. Push for transparency. Support legislation like the Preserve Access Act. And don’t settle unless you get ironclad guarantees. The FTC is watching. The courts are listening. And patients? They’re starting to wake up. You’re fighting for more than profit - you’re fighting for dignity. Keep going. We’ve got your back. 💪